Navigating the physical and emotional impacts of cancer is hard enough. But during and after cancer treatment, many patients and families must endure another struggle: affording the cost of their care.

That’s why, over the last 12 months, LLS helped secure new laws in 10 states that will protect patients from medical debt – a financial burden they face through no fault of their own. These policies are addressing debt that has already been incurred, as well as helping patients avoid future debt.

Cancer care is too costly – even with comprehensive health insurance. Many patients end up accruing medical debt, which can translate to losing their homes, affecting their ability to feed their families, and even preventing them from getting the care they need.

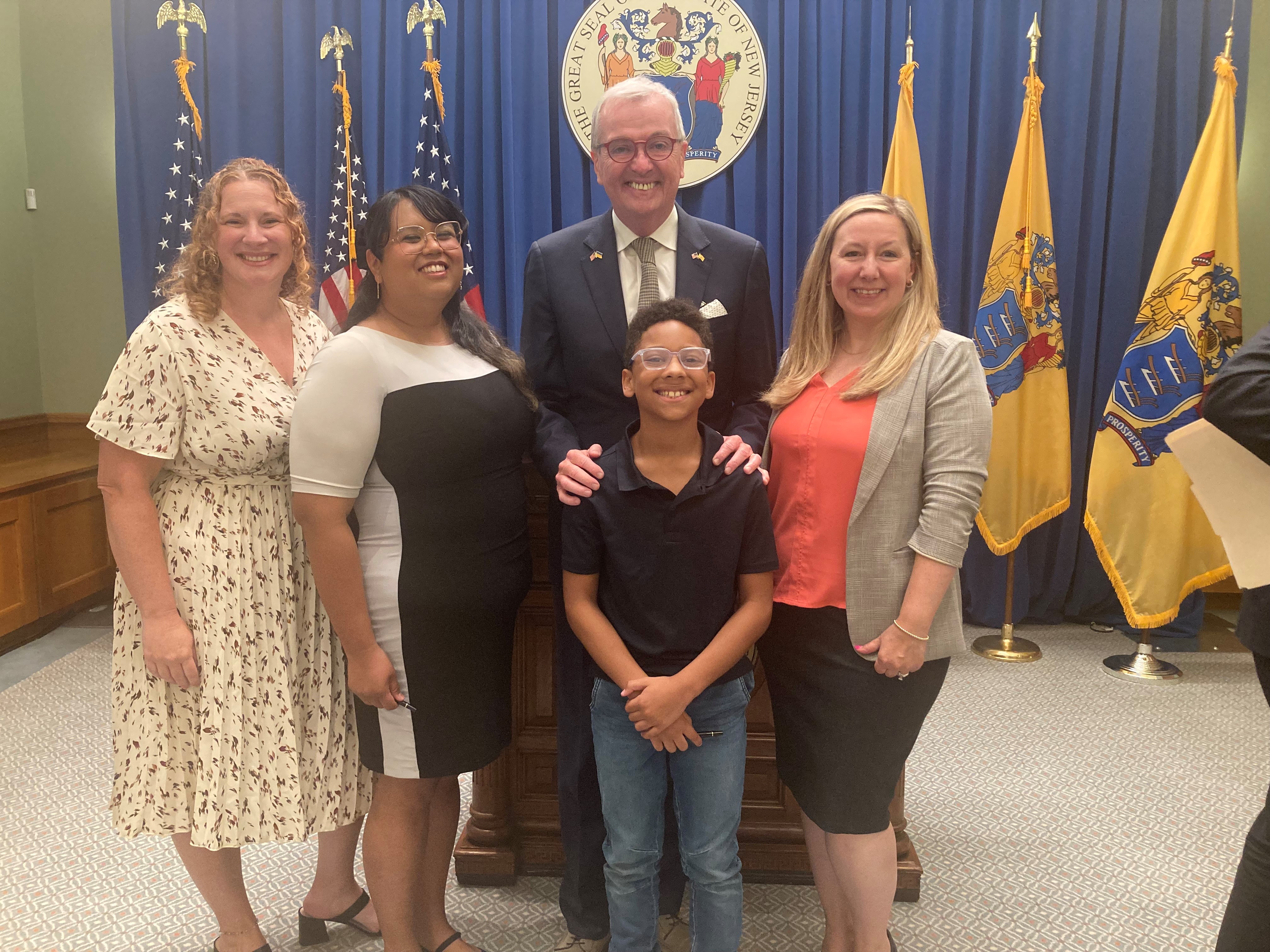

“I have delayed doctor’s appointments to avoid co-pays. I stopped seeing a primary care physician and have relied on a local urgent care provider. I recently learned I cannot be seen there unless I put money toward the $500 I owe them,” said Amanda Schlesier, LLS New Jersey Advocacy Leader in her testimony to support legislation in New Jersey, which was just signed into law. “Financially, I feel hopeless and ashamed because six years ago, my body betrayed me, and now, I cannot afford to keep up."

Here at The Leukemia & Lymphoma Society (LLS), we offer direct financial support to patients—but we’re also advocating for policy change through our Office of Public Policy (OPP). OPP works to advance policies that both protect patients who already have medical debt and prevent future patients from accumulating future medical debt.

These types of policies are popular: more than 9 in 10 people say it’s time for elected officials to protect people with serious diseases like cancer from overwhelming medical debt, according to a poll commissioned by LLS and other groups last year.

As Americans demand action, lawmakers at both the state and federal levels are responding with new bills designed to prevent people from getting trapped by medical debt—and LLS is working diligently to get them passed into law. Here’s a taste of the reforms we’ve helped secure so far.

Credit reporting reforms

When patients get unaffordable medical bills, it can harm their credit—and cast a shadow on their finances for years, or even decades. Medical debt is the most common type of debt on consumers’ credit reports. Yet, having medical debt is not a good predictor of whether an individual will repay a loan or other bills.

Knowing this, Colorado, Connecticut, Illinois, Minnesota, New Jersey, New York, Rhode Island and Virginia have all prohibited the reporting of medical debt to credit bureaus. LLS supported campaigns in each state to enact this change.

LLS also worked with the administration to address this concern on the federal level. In June, the Consumer Financial Protection Bureau proposed to ban medical debt in most cases from credit reports. If adopted, this policy could improve patients’ credit scores and reduce the devastating impacts of medical debt.

Hospital assistance reforms

Non-profit hospitals are required to provide financial assistance to patients who qualify. But these same hospitals are not required to screen patients for eligibility—or even tell patients that these programs exist. That means help may be available, but patients aren’t aware of it. With LLS support, Illinois, Oregon, and Rhode Island recently passed laws that require hospitals to prescreen patients to see if they qualify for hospital assistance and also pre-screen patients for public health insurance eligibility.

North Carolina also recently unveiled a plan that would incentivize hospitals to forgive certain medical debt.

Prohibiting wage garnishments and liens

In some cases, if patients are unable to pay their medical bills, creditors can either garnish wages directly from a patient’s paycheck or place a lien on their property. Arizona, Colorado, New Jersey, New York, and Minnesota have enacted policies to limit or ban these predatory practices and protect families from losing their homes or cars due to medical debt.

Other policy solutions include giving patients more time to pay back bills, restricting harmful debt collection practices, and limiting or eliminating medical debt from accruing interest. For instance, Maine just passed a law requiring 0% interest and fees on medical debt.

Join us in the fight against medical debt

Patients and their families should never find themselves worse off because they’re trying to survive cancer. We are proud to lead the charge against medical debt—and are always looking for more voices. Add your voice to ours by signing up to be an advocate here. Once you do so, we’ll let you know when your voice is needed to help create meaningful change for patients in your state.